IT’S STILL

EARLY

Schopenhauer classifies revolutions through three stages: ridiculous, frightening, and obvious.

The nascent crypto and blockchain ecosystem is in its Spring, developing at a rapid rate, and showing features of all three stages.

We expect disruption in most industries, with a revolution for those dealing in transfer, storage and accumulation of value.

A multitrillion-euro ecosystem will almost certainly be built with cryptocurrency on the blockchain.

WELCOME TO THE FOURTH INDUSTRIAL REVOLUTION

WE ARE MOVING TO A FULLY DIGITAL WORLD

Supercomputing that is accessible and mobile. Robots that are intelligent. Cars that drive themselves. Brain upgrades using neurotechnology. Manipulation of genetics.

Total people mining

People supporting Bitcoin

Institutions supporting Bitcoin

Countries supporting Bitcoin

People expected to be mining in 10 years

People believe crypto will become mainstream in 10 years

Institutions believe crypto will become mainstream in 10 years

Countries believe crypto will become mainstream in 10 years

The above data is based on research conducted by BCG, PwC, Bitstamp, Forbes, and the Rollman Group

WHY NOW

THERE ARE THREE BIG THINGS HAPPENING AT THE SAME TIME THAT ARE SHAPING OUR CULTURE AND TECHNOLOGY

We expect the below to play out over a decade and this will create the largest shift of wealth in the history of the internet.

Consumer trust in governments, banks and corporations is getting worse.

Consumer trust in governments, banks and corporations is getting worse.

Cryptocurrency networks use new programmable tools to give innovative approaches for coordinating economic activity and encouraging human behaviour.

Cryptocurrency networks use new programmable tools to give innovative approaches for coordinating economic activity and encouraging human behaviour.

Software is destroying traditional finance, including the fundamental concept of money.

Software is destroying traditional finance, including the fundamental concept of money.

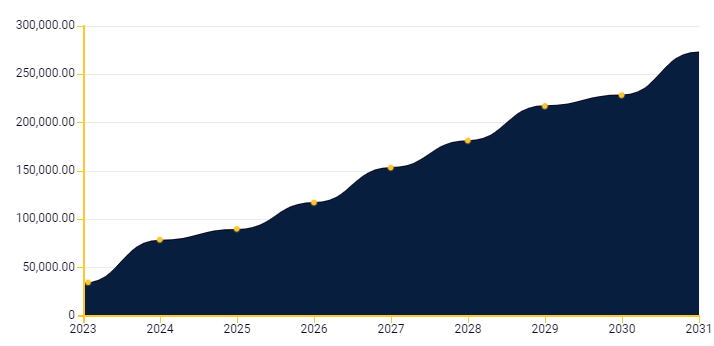

BITCOIN FORECAST

2023 – 2031

If you understand the design of something; you know what it’s going to do.

Our Bitcoin market forecasts are determined using various machine-based algorithms which analyse various technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Moving Average (MA), Average True Range (ATR) and Bollinger Bands (BB).

WHY NOW

LEGENDARY INVESTORS INVOLVED

The list of big-name investors in cryptocurrency is expanding.

Founder of McAfee

“You can’t stop things like Bitcoin. It will be everywhere, and the world will have to readjust. World governments will have to readjust”

Co-Founder of Microsoft

"The future of money is digital currency.”

Founder and CEO of MicroStrategy

“If you don’t fear inflation, regulation, war, famine, complexity, competition, corruption, coercion, confiscation, or chaos, then you don’t need Bitcoin.”

Founder and Chairman of the World Economic Forum

“I’m convinced that we are at the beginning of a revolution that is fundamentally changing the way we live, work, and relate to one another.”

Founder of Tudor Investment Corporation

Investing in Bitcoin is “...like investing with Steve Jobs and Apple or investing in Google early… I think we are in the first inning of Bitcoin and it’s got a long way to go.”

Chairman and President of Dusquesne Capital Management

“I’m a bit of a dinosaur, but I have warmed up to the fact that Bitcoin could be an asset class that has a lot of attraction as a store of value.”

Founder and CEO of Pantera Capital

“I believe Bitcoin is the biggest trade of our generation... Bitcoin would rise to around $36,000 before the halving and reach a high of almost $150,000 after.”

Co-founder of Paypal

“I do think Bitcoin is the first [encrypted money] that has the potential to do something like changing the world.”

SOME OF THE OTHER BIG-NAME CRYPTO SUPPORTERS

Founder of Miller Value Partners

CEO of Fidelity Investments

Head of Mad Money on CNBC

Entrepreneur

Entrepreneur

Founder and CEO of Social Capital

Founder of Draper Fisher Jurvetson

Co-Founder of Twitter

Co-Founder and Chairman of AngelList

Founders of Winklevoss Capital Management

CEO of Tesla, SpaceX, and Twitter

CEO of Galaxy

WHY NOW

CORPORATIONS AND INSTITUTIONS ARE BUYING

Corporations and institutions are moving to bitcoin as a hedge in what has been an unparalleled year of

macroeconomic uncertainty, monetary and fiscal policies, while more economic turmoil is on the horizon.

Tesla invested $1.5 billion into Bitcoin and will accept Bitcoin as a payment method.

Square invested 1% of total assets into Bitcoin totalling 4,709 BTC.

MicroStrategy invested $4.17 billion into Bitcoin in a long-term store of value.

MassMutual, founded in 1851, invested $100 million in Bitcoin from its general account.

SOME OF THE COMPANIES SUPPORTING CRYPTO

UNIVERSITIES INVESTED IN CRYPTO

KEY FIGURES

AT 06/2023