El Salvador’s ambitious renewable energy Bitcoin mining operation welcomes its first mining pool as Volcano Energy…

You're reading

Posted at June 1, 2023 | Post by Victor Rollman

In recent years, cryptocurrencies have gained significant attention and popularity. As a result, many investors are considering adding digital assets to their investment portfolios. This blog aims to provide a fact-based exploration of why including crypto in a modern portfolio is becoming increasingly important.

Experts agree that, no matter your age, cryptocurrencies should make up between 5% and 20% of your portfolio.

Source: forbes.com, cnbc.com

Bitcoin mining is taking the conservative and responsible way to investing in cryptocurrencies, more bitcoin for your money.

Diversification and Risk Management:

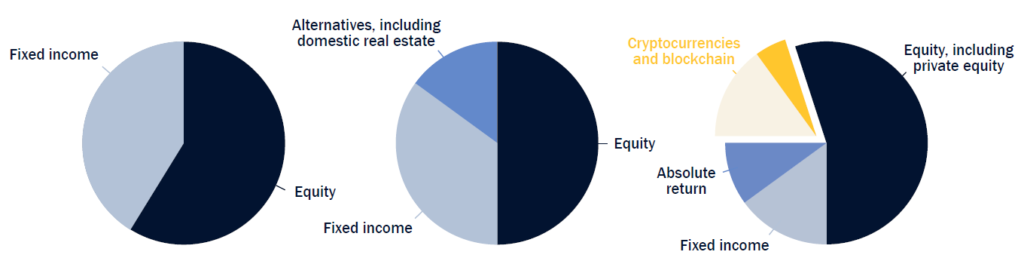

Diversification is a fundamental principle in investment management. Including cryptocurrencies in a portfolio can offer diversification benefits due to their low correlation with traditional asset classes such as stocks and bonds. Cryptocurrencies’ unique risk-reward characteristics can help mitigate portfolio risk and enhance overall returns.

Strong Historical Performance:

Despite its relatively short existence, the cryptocurrency market has demonstrated impressive growth and returns. Bitcoin, the pioneering cryptocurrency, has shown remarkable resilience and has been one of the best-performing assets over the past decade. Historical data indicates that including crypto in a portfolio can potentially enhance long-term performance.

Hedge against Inflation and Economic Uncertainty:

Cryptocurrencies like Bitcoin have gained attention as a potential hedge against inflation. Unlike fiat currencies that can be influenced by central banks and governments, cryptocurrencies are decentralized and have a finite supply. As a result, they may provide protection against currency devaluation and serve as a hedge in times of economic uncertainty or geopolitical turmoil.

Increasing Institutional Adoption:

The institutional adoption of cryptocurrencies has been growing steadily. Major financial institutions, such as PayPal, Visa, and Square, have integrated cryptocurrencies into their platforms. Additionally, renowned asset management firms and hedge funds have started allocating capital to digital assets. This institutional acceptance and involvement lend credibility to the crypto market, making it an attractive addition to a modern portfolio.

Technological Innovation and Disruption Potential:

Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to disrupt various industries. Its features, such as transparency, security, and efficiency, make it appealing for applications beyond finance, including supply chain management, healthcare, and voting systems. By investing in cryptocurrencies, investors can gain exposure to this technological revolution and potentially benefit from its widespread adoption.

Increased Accessibility and Liquidity:

The accessibility of cryptocurrencies has significantly improved, thanks to the development of user-friendly platforms and exchanges. Investors can now easily buy, sell, and hold digital assets. Additionally, liquidity in the cryptocurrency market has increased, allowing for seamless transactions and improved price discovery. These factors contribute to the overall attractiveness and viability of including crypto in a modern investment portfolio.

Conclusion

Conclusion: The decision to include cryptocurrencies in a modern portfolio is a personal one that should be based on careful consideration of individual risk tolerance and investment objectives. However, the growing institutional adoption, historical performance, diversification benefits, potential as a hedge against inflation, technological innovation, and increased accessibility all make a compelling case for including crypto in a well-rounded investment strategy. As with any investment, thorough research and consultation with financial professionals are essential to make informed decisions about portfolio allocation.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

El Salvador’s ambitious renewable energy Bitcoin mining operation welcomes its first mining pool as Volcano Energy…

In the ever-evolving landscape of cryptocurrency, two formidable forces are poised to steer the industry into…

Blockchain.com, a cryptocurrency enterprise offering a digital asset exchange, a blockchain explorer, and a non-custodial wallet,…