Bitcoin rallied to its highest level since May 2022, as bullish sentiment exploded throughout the market.…

You're reading

Posted at December 19, 2023 | Post by Victor Rollman

An institutional investor survey conducted by digital asset bank Sygnum indicates a shift from skepticism to advocacy, “with over 80% now agreeing that crypto has an important role to play in the global financial industry,” said the bank’s digital asset research manager. “It’s now truly becoming a trusted gateway that is rapidly transforming the economic landscape.”

Digital asset bank Sygnum launched its inaugural institutional crypto market report last week. The report, titled “Future Finance 23,” features an institutional investor survey the bank conducted at the beginning of Q4 with more than 150 respondents possessing an average of over 10 years of investment experience. They included Sygnum’s institutional client base and equity investors, banks, hedge funds, multi and single-family offices, foundations, and asset managers.

According to the survey, 87% of respondents invest in “blockchain protocol tokens like bitcoin, ethereum, and solana (Layer 1 protocols).” In addition, 57% of respondents plan to increase their crypto asset allocation in the future.

Regarding why they invest in crypto, the report notes that 66% of respondents said it’s to “gain exposure to the crypto megatrend” while 46% cited portfolio diversification as their investment driver. Sygnum described:

This illustrates ongoing institutional adoption and growth of hybrid traditional-crypto portfolios, as well as a deepening knowledge of blockchain technologies.

Moreover, among respondents who plan to maintain or increase their crypto asset allocations, 62% expect higher future returns.

Meanwhile, 37% of investors “consider crypto a superior investment than traditional assets, demonstrating its attractiveness as a traditional-market hedge,” the report details. “Direct token investments remain the top choice for all respondents, indicating a clear preference for investment via direct ownership of tokens and generating yields through staking. This preference might shift as financial products continue to evolve and diversify.”

Sygnum Digital Asset Research Manager Lucas Schweiger, the report author, commented:

As the crypto industry has evolved, many institutional investors have also evolved from sceptics to evangelists, with over 80% now agreeing that crypto has an important role to play in the global financial industry. It’s now truly becoming a trusted gateway that is rapidly transforming the economic landscape.

Fabian Dori, Chief Asset Management Officer and Sygnum Group Deputy CEO, opined: “Over 85% of institutional crypto investors in our study believe that being regulated is essential to building trust. This is further confirmation that Sygnum’s founding strategy to be fully regulated from day one in all our regions was the right one.”

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

Bitcoin rallied to its highest level since May 2022, as bullish sentiment exploded throughout the market.…

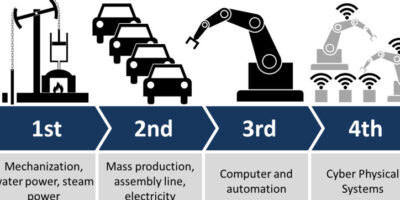

We are moving to a fully digital world Thanks to the global internet, participants in the…

The crypto economy has dropped more than 2% on Monday morning as equity futures show U.S.…