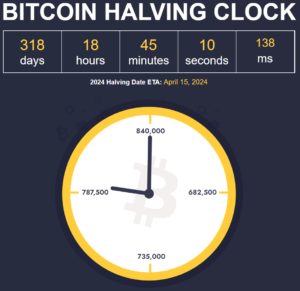

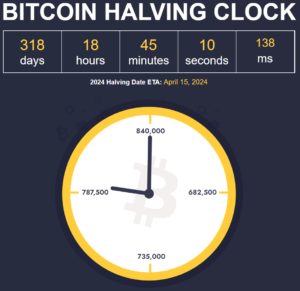

The Bitcoin halving event is a programmed adjustment that occurs approximately every four years in the Bitcoin protocol. It reduces the block reward miners receive for successfully mining a block by half. The purpose of the halving is to control the supply of new bitcoins entering circulation and maintain a predictable issuance schedule.

During the first four years of Bitcoin’s existence, the block reward was 50 bitcoins. In 2012, the first halving reduced it to 25 bitcoins, and in 2016, it decreased to 12.5 bitcoins. The most recent halving took place in May 2020, reducing the block reward to the current rate of 6.25 bitcoins.

Investors often position themselves before a halving event due to several reasons:

- Scarcity and Potential Price Appreciation: The halving reduces the rate at which new bitcoins are created, increasing the scarcity of the cryptocurrency. With a limited supply and growing demand, investors anticipate that reduced supply will lead to upward pressure on the price of Bitcoin over time.

- Supply-Demand Dynamics: As the block reward is halved, the supply of new bitcoins entering the market decreases. This reduction in the rate of supply combined with ongoing demand can create a supply-demand imbalance, potentially driving the price higher.

- Market Sentiment and Speculation: Halving events generate excitement and speculation within the cryptocurrency community. Investors often anticipate price increases based on historical patterns, increased media attention, and the belief that the event’s significance will attract new participants and institutional investors.

- Long-Term Investment Perspective: Many investors view Bitcoin as a long-term investment and store of value. They consider the halving event as a fundamental driver that reinforces the scarcity and value proposition of Bitcoin over time.

Bitcoin is often the preferred way to position oneself before a halving event due to its unique characteristics:

- Limited Supply: Bitcoin has a maximum supply cap of 21 million coins, making it inherently scarce. The halving event reinforces this scarcity by gradually reducing the rate of new supply issuance.

- Decentralization and Security: Bitcoin’s decentralized nature and robust security measures provide investors with confidence in the integrity and longevity of the network. This has contributed to Bitcoin’s status as the preferred cryptocurrency and store of value for many investors.

- Market Liquidity: Bitcoin is the most widely traded and liquid cryptocurrency, with a large and active market. This liquidity allows investors to easily buy and sell Bitcoin, making it a convenient asset for positioning themselves before and during halving events.

- Historical Performance: Previous halving events have coincided with significant price increases for Bitcoin. While past performance is not indicative of future results, investors often consider historical data when making investment decisions.

In the past, the Bitcoin halving event has had a notable impact on the price of Bitcoin. While historical patterns do not guarantee future results, understanding these past trends can provide insights into how the halving event has influenced Bitcoin’s price. Here’s a summary of the impact the halving events had on Bitcoin’s price in the past:

- 2012 Halving: The first halving occurred in November 2012 when the block reward reduced from 50 bitcoins to 25 bitcoins. At that time, Bitcoin’s price was relatively low, trading around $12. Following the halving, the price began a gradual upward trend and experienced significant growth over the following months and years. By the end of 2013, the price had surged to over $1,100.

- 2016 Halving: The second halving took place in July 2016, reducing the block reward from 25 bitcoins to 12.5 bitcoins. Before the halving, Bitcoin’s price was trading around $650. Post-halving, the price remained relatively stable initially but started to increase significantly over time. In December 2017, around 17 months after the halving, Bitcoin reached its all-time high price of nearly $20,000.

- 2020 Halving: The most recent halving occurred in May 2020, reducing the block reward to 6.25 bitcoins. Prior to the halving, Bitcoin’s price was around $8,500. Following the event, the price experienced a relatively modest increase in the short term. However, in the months that followed, Bitcoin’s price began a strong upward trajectory. By April 2021, less than a year after the halving, Bitcoin surpassed its previous all-time high, reaching over $64,000.

It’s important to note that while halving events can generate market excitement and potential price appreciation, they are not the sole determinant of Bitcoin’s value. Bitcoin’s price is influenced by a range of factors, including market sentiment, adoption rates, regulatory developments, macroeconomic conditions, and technological advancements.

Investors should carefully consider their risk tolerance, conduct thorough research, and seek professional advice before making investment decisions related to halving events or any other aspect of cryptocurrency investing.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com