In a surprising turn of events, Stanford University has announced its intention to return the entirety…

You're reading

Posted at January 5, 2024 | Post by Victor Rollman

Shark Tank investor Kevin O’Leary, also known as Mr. Wonderful, has emphasized that institutional interest in crypto and bitcoin will remain high regardless of the U.S. Securities and Exchange Commission (SEC)’s decision on spot bitcoin exchange-traded funds (ETFs). “Even a no decision will not change the long-term potential,” he stressed.

Kevin O’Leary, the chairman of O’Leary Ventures, has weighed in on the potential impact of the U.S. Securities and Exchange Commission (SEC) approving spot bitcoin exchange-traded funds (ETFs) on institutional interest in crypto.

He shared on social media platform X Wednesday: “Bitcoin has a spectacular appreciation. Why? The anticipation of the SEC approving the first bitcoin ETF before Jan 10th. I’m not so sure. Gary Gensler at the SEC has never confirmed any timetable for a bitcoin ETF.” However, Mr. Wonderful noted:

Even a no decision will not change the long-term potential!

In an interview on Tradertv Live on Dec. 29, O’Leary clarified that he doesn’t expect the SEC to approve a spot bitcoin ETF. “I’m in the camp that says he [Gensler] won’t do it,” he said, adding that the SEC chairman has “a mandate that’ll be for another 18 months.”

Nonetheless, Mr. Wonderful believes that the SEC’s decision on spot bitcoin ETFs will not affect institutional investor demand for crypto. He opined:

Even if he says no, I don’t think it’s going to change the momentum of what’s occurring here, because really big things happen to change institutional interest to the upside in crypto.

“The big holdback on bitcoin and ethereum, the granddaddies of crypto, has been the fact that institutions, particularly sovereign wealth, have not allocated their traditional 1% to 3% to that asset class. Well, they are waiting for the regulator to approve it,” Mr. Wonderful detailed.

In November last year, O’Leary revealed that “all” of the institutions and major organizations that he had talked to are prepared to invest in bitcoin. “They aren’t interested in the 10,000 token story,” he said, adding: “Bitcoin is proving itself to be liquid enough, it’s proving itself to be a storage of wealth, most people consider it a commodity.”

The Shark Tank star also said at the time that a spot bitcoin ETF approval hinges on the existence of an exchange that’s fully compliant with the SEC. To him, Coinbase, the Nasdaq-listed crypto exchange, lacks compliance due to its ongoing legal conflict with the securities regulator. Moreover, O’Leary previously said that crypto regulations in the U.S. are getting “very aggressive.” He believes that most crypto tokens are worthless and will eventually go to zero.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

In a surprising turn of events, Stanford University has announced its intention to return the entirety…

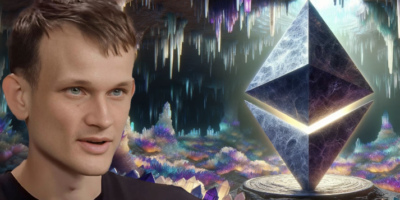

Monitoring of high-profile crypto addresses by onchain analysts has recently revealed that Ethereum co-founder, Vitalik Buterin,…

Tesla CEO and Spacex chief Elon Musk has revealed that he still owns “a bunch of…