In the world of cryptocurrencies, the pace of innovation and investment can be nothing short of…

You're reading

Posted at October 1, 2023 | Post by Victor Rollman

A Bitcoin ATM (Automated Teller Machine) or BTM (Bitcoin Teller Machine) is a popular means of bypassing the traditional banking system of buying or cashing out Bitcoin

They have grown in popularity over the years alongside the rising value of cryptocurrencies and the increased level of trust in them.

Other ATMs that allow users to buy and/or sell other cryptocurrencies such as Ethereum, Bitcoin Cash, Dash and Litecoin, among others.

If you haven’t used one yet or would like to learn more about it, keep reading. In this article, we’ll be discussing a few interesting points regarding Bitcoin ATMs. We’ll also provide you with helpful information, such as the typical requirements and steps you need to keep in mind when buying or selling Bitcoin.

We’ll also answer questions such as how do I deposit money into a Bitcoin ATM? How much does it cost to use a Bitcoin ATM?

An ATM or BTM is similar to a regular automated teller machine in that it is a physical kiosk. What differentiates it from typical ATMs, of course, is that it allows users to buy Bitcoin in exchange for cash or debit. Some BTMs also allow users to sell Bitcoin for cash.

BTMs look like typical ATMs. However, they connect to a Bitcoin wallet instead of a bank account. In place of a bank card, the Bitcoin wallet serves as a repository from which coins are sent or debited. Some Bitcoin ATMs look very similar to traditional ATMs because they are indeed traditional ATMs with software customized for Bitcoin.

The first ATM for cryptocurrency first opened on October 29, 2013. It was a Robocoin machine located in Canada’s Waves Coffee Shop in Vancouver. It only operated until 2015 due to operating errors from Bitstamp, but it is widely recognized as the world’s pioneering Bitcoin ATM. A Bitcoin ATM was then opened in Europe shortly thereafter. It was located in Bratislava, Slovakia, and was installed on December 8, 2013.

Meanwhile, the first Bitcoin ATM in the United States was installed on February 18, 2014, in Albuquerque, New Mexico. It was, however, short-lived and was pulled out after only a month of operating.

Much like the cryptocurrency itself, Bitcoin ATMs have since faced many challenges concerning regulations. Finally, a consensus was reached upon agreeing that Bitcoin ATMs also had to adhere to the same laws and regulations as traditional ATMs.

This includes limits on the number of deposits and withdrawals that could be made by a person per transaction, per day. For instance, in the United States, all Bitcoin ATM operators must register with the Financial Crimes Enforcement Network (FinCEN) and follow the Bank Secrecy Act’s (BSA) Anti-Money Laundering (AML) regulations.

The Bitcoin ATM may need your cell phone number to send you a text verification code depending on the transaction quantity. Before completing a transaction, you may be required to scan a government-issued piece of identification, such as a driver’s license.

Also, much to the dismay of many crypto enthusiasts, a lot of Bitcoin ATMs no longer offer the anonymity they once did. This is because of regulations in place that require users to verify their identity before transacting, especially for large amounts.

There are currently around 28,000 Bitcoin ATMs globally, with a large majority located in the United States. North America holds the largest market share of Bitcoin ATMs globally at almost 90 percent. Today, the biggest manufacturers of Bitcoin ATMs are Genesis Coin (41.5% market share) and General Bytes.

Most BTMs are found in cafes or specialty shops, as well as transport hubs like rail stations and airports. Generally, business owners who would want to have a BTM installed inside a commercial space will have to enter into a contract with a Bitcoin ATM provider. The provider will then take care of installing the device on-site.

Unlike online crypto exchanges, Bitcoin ATMs allow for convenient buying and selling of Bitcoin. Generally, Bitcoin ATMs require users to have an existing account so they can use the machine.

The two types of Bitcoin ATMs or BTMs are:

BTMs need to be connected to the internet in order to power the exchange of cryptocurrency for cash. BTMs typically move money via a public key on the blockchain, while some still use paper receipts. Bitcoin ATMs also often require a verification process, especially when transacting large amounts.

As opposed to traditional ATMs that allow for physical deposits and withdrawal of funds, Bitcoin transactions are blockchain-based. They send cryptocurrencies to a user’s Bitcoin wallet via a QR code. Because they do not connect to a bank account, they are also not operated by large financial institutions. However, as we mentioned, they adhere to similar laws and regulations.

Users will usually be prompted to scan a QR code that corresponds to their Bitcoin wallet address. After which, purchased coins can be transferred to their wallet. A record of the transaction will then appear in the user’s digital wallet after a few minutes of processing.

There are also lower and upper limits on the cash that can be deposited via a BTM. Within the U.S., all Bitcoin operators are required to register with FinCEN. They are also subject to the AML clauses of the Bank Secrecy Act (BSA). The Bitcoin ATM may need your cell phone number to send you a text verification code depending on the transaction quantity. Before completing a transaction, you may be required to scan a government-issued identity, such as a driver’s license.

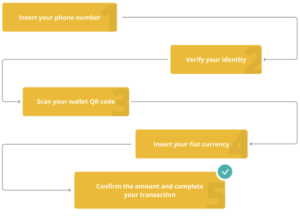

Below are the typical steps for exchanging your fiat currency for Bitcoin using a Bitcoin ATM. In short, here’s how to buy Bitcoin from a Bitcoin ATM:

Bitcoin ATMs require identity verification. You are usually asked for your mobile number to get a verification code before proceeding with your transaction.

Whereas Bitcoin ATMs used to be big on anonymity, nowadays, they need to be compliant with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

According to the law, all BTMs must have some type of identity verification, such as scanning a government-issued ID or providing a phone number.

After submitting your phone number, you will now have to verify your identity. You can do this by waiting for the verification code that the BTM will send to your number via text message. Then, you have to input that exact code into the machine you are using.

You will then get a prompt that says, “Your code is 7654321. Thank you,” or a variation of such. BTM manufacturers incorporated this step to deter people from inputting fake phone numbers into the BTMs.

If you’re using a Bitcoin ATM, it’s highly likely that you already have a Bitcoin address. This is where the actual BTC will be sent.

Before using a Bitcoin ATM, you need to have a Bitcoin address. This is where the machine will send the actual BTC to. If you don’t already have one, there are a couple of ways to get a Bitcoin public address:

Using a paper wallet

Using an application

Using an address on an exchange

That being said, what’s important is your QR code. This represents your Bitcoin address, so you’ll have to scan it in order to let the Bitcoin ATM know where exactly it has to send your BTC. Note that BTC ATMs support multiple wallets. So, it’s best to check with your wallet provider if you’re unsure.

Now, you’ll simply need to insert how much you want to exchange for Bitcoin. Much like a conventional ATM that accepts cash deposits, you just need to place your money inside the machine’s designated receptacle.

The machine will then let you know how much its value is in terms of Bitcoin. For example, if you insert $400, you will see a prompt that looks like this: $400 USD = 0.0095 BTC.

Once you’ve double-checked that you inserted the correct amount of money and are satisfied with the exchange, all you have to do is press “BUY” or “CONFIRM.” The Bitcoin you just purchased will then be sent to your Bitcoin address, which you confirmed earlier using your QR code.

Selling Bitcoin using ATMs

Depending on the machine, you can either buy Bitcoin, sell it, or do both. The directions vary per machine. However, in most cases buying or selling cryptocurrency isn’t too different from withdrawing money using a bank card.

Here are the general directions for when you want to cash out or sell Bitcoin at a Bitcoin ATM:

Select your desired option. If you want to cash out, click “Sell BTC.”

Scan your wallet QR code. You can scan it from your mobile app, print it out, or enter the address manually.

Verify your identity. This varies from country to country, but most BTMs require users to enter a phone number, scan a valid ID, or take a photo. Some machines even accept fingerprints. Verification is a must for transactions that involve large amounts of BTC.

Send the cryptocurrency to the specified address. This can usually be done by scanning a QR code. Some machines issue cash right away, while some will have you wait for the receiver to confirm the transaction.

Confirm the transaction on your end and wait for the machine to complete the transaction.

Don’t forget to keep your receipt.

The steps for using BTMs to sell Bitcoin are much more varied, but these are the basic steps you will be asked to perform. Then again, they are typically easy to use and very intuitive, so just pay attention to the on-screen instructions and make sure to key in the right information.

Some of the advantages of using a Bitcoin teller machine are:

It’s a fast and convenient way to buy and/or sell Bitcoin.

There are no physical cards or bank cards needed to transact.

Some machines (in countries that don’t require KYC) don’t require identity verification, keeping you anonymous.

Offers Bitcoin access to individuals who do not have or prefer not to have bank accounts.

Makes buying Bitcoin accessible in areas where there are limited ways to purchase cryptocurrency.

It’s an accessible way to transact Bitcoin, as there are many BTMs globally.

There are also some disadvantages that come with using Bitcoin Teller Machines. Some of them are:

Very high transaction fees. Bitcoin ATM fees typically range from 7% to 12% for buying or selling Bitcoin.

It might not be suitable for large transactions as most Bitcoin Teller Machines limit withdrawals and deposits (ranging from $1000 – $10,000).

Most locations demand identity verification, meaning your transaction will not be completely anonymous.

As mentioned earlier, there are around 28,000 BTMs around the world, with the majority of them in North America. Here is a map showing the distribution of Bitcoin ATMs around the world:

Statista reports that most BTMs are located in North America and Europe, with other machines spread sparingly across other regions.

To find the exact location of a Bitcoin Teller Machine near you, you can visit Coin ATM Radar to conduct a local search. All you have to do is type in your address or city to find the closest BTM.

Here’s how you can locate a Bitcoin Teller Machine using Coin ATM Radar:

Navigate to Coin ATM Radar. Here, you’ll see a Bitcoin ATM map showing locations all over the world.

On the upper left-hand portion of the map, type in your city or address and press “enter.”

You can also filter according to:

Click on a Bitcoin Teller Machine location near you to see the details. You can see information regarding the following:

The building/location’s name

Operating hours

Supported cryptocurrencies

Supported transactions

Although Bitcoin Teller Machines have been around for quite a while now, it still remains a pretty innovative concept that earns both curiosity and suspicion.

Here are some important (and interesting) facts about this piece of technology:

The technology behind Bitcoin ATMs is still relatively young. As such, it is still continually improving alongside changes in security measures and regulations to abide by.

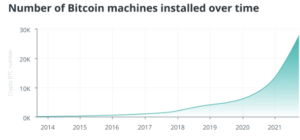

However, BTMs have come a long way since the first Robocoin machine was installed at a Vancouver coffee shop in 2013. Today, it has grown exponentially in numbers, which goes to show that the general public is also very quickly adopting Bitcoin.

In 2020 alone, Bitcoin ATMs in the U.S. saw a massive uptick (177%) in installations, perhaps due to the increased demand for cashless payment methods. Coin ATM Radar’s data on Bitcoin ATM installations show a huge upwards trend, with numbers approaching 30,000 in 2021:

Given where we are right now in terms of the general population’s acceptance of cryptocurrency and Bitcoin ATMs, it looks like numbers will continue to rise over the coming years.

So, how much does it cost to use a Bitcoin ATM? As we discussed, Bitcoin ATM fees remain quite high despite the increasing popularity of BTMs. Typical Bitcoin ATM fees are at 10% to 15%. However, they can go as low as 7% or as high as 25%.

If, for example, you’re buying $800 worth of Bitcoin with a $10 average buy fee, you will receive $720 worth of bitcoin and pay a fee of $80. That’s quite significant.

On the other hand, let’s say you’re selling $1,000 worth of bitcoin at a 7% sell fee. This means you will only receive $930 of your fiat currency and pay a fee of $70 for the transaction. Again, it’s quite a significant chunk of money.

The way around this is to research before going to a machine near you. That way, you can pre-determine which machines have the lowest fees.

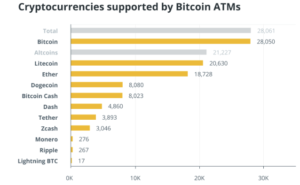

Although they are called Bitcoin ATMs, most of these machines actually support transactions involving other altcoins. This means that you can use them to buy or sell other cryptocurrencies aside from Bitcoin.

Here is a chart showing the ratio of cryptocurrencies to Bitcoin ATMs that support them:

Bitcoin ATM technology is still relatively new, hence the limited number of other cryptocurrencies supported by these machines. There are currently 1600 different types of altcoins, so it might be a long way to go before all of them are supported by major BTM manufacturers.

However, seeing the rapid increase and acceptance of BTM technology, there is a very good possibility that we will continue to see the incorporation of more altcoins being supported by BTM manufacturers worldwide.

Bitcoin has continued to increase in value since its inception in 2013. Back then, one Bitcoin was worth around $200. Years later, its worth has risen to thousands of dollars despite price fluctuations.

Alongside its massive growth in value, the number of Bitcoin ATMs also increased exponentially. This highlights the continuing patronage of Bitcoin and other cryptocurrencies.

As the world continues to shift to digital solutions by and large, including financial transactions, Bitcoin and other crypto are also expected to become even more popular.

Since Satoshi Nakamoto mined the first-ever Bitcoin, it has remained an independent online currency, free of the grip of regulatory bodies and large financial institutions.

This is also the reason why a lot of global leaders, financial elites and economists have repeatedly raised suspicions around it. However, owing to Nakamoto’s “near-perfect code,” thankfully, the Bitcoin blockchain has never been hacked since it was invented.

Despite this, there is no guarantee that the Bitcoin blockchain will remain impregnable indefinitely. Nonetheless, investors and enthusiasts are riding on its track record, and remain assured of the cryptocurrency’s continued security and success.

Congruent to that, it is highly expected that Bitcoin ATMs will likely continue to increase in number and popularity over the next few years. People like them because they are accessible, convenient and novel. Bitcoin ATM fees remain one of the technology’s major flaws, but as of now, it can’t be helped, as it affords a lot of people a secure and convenient way to purchase crypto.

If you’re planning on buying or selling Bitcoin through a Bitcoin ATM, remember to check online resources first so you can gauge which Bitcoin ATMs offer the lowest fees. Also, ensure that you are always inputting the right details (such as details about your digital wallet), as there is often no way to undo transactions caused by such errors.

We hope this article helped you learn about the basics of Bitcoin Teller Machines. As always, feel free to check our homepage regularly for the latest rates, news and updates about various cryptocurrencies.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

In the world of cryptocurrencies, the pace of innovation and investment can be nothing short of…

In the last 100 days, South Korea’s crypto trading activity has experienced a significant upswing. The…

A similar report from another Chinese court in September recognized cryptocurrencies as virtual properties protected by…