With the exponential growth of Bitcoin mining, choosing the right location for hosting sites is crucial.…

You're reading

Posted at April 29, 2024 | Post by Victor Rollman

BlackRock, the world’s largest asset manager, has made waves in the financial world with its strategic approach to Bitcoin acquisition. Rather than purchasing the cryptocurrency directly from exchanges, BlackRock has opted for a unique method: mining Bitcoin. This tactic allows the company to secure Bitcoin at a significant discount, around 20% below market price.

In the realm of finance, where innovation often meets tradition, BlackRock’s recent strategic move has turned quite a few heads. The world’s largest asset manager has set its sights on Bitcoin, but it’s not just buying it on the market like many other investors. Instead, BlackRock has found a unique way to acquire the leading cryptocurrency at a significant discount – through Bitcoin mining.

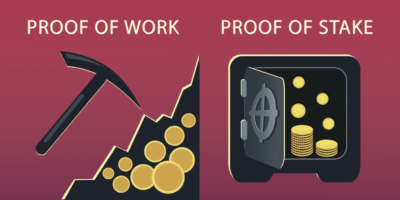

Bitcoin mining, the process by which new bitcoins are created and transactions are verified on the blockchain, has long been known for its potential profitability. However, as the industry matures and competition intensifies, mining Bitcoin profitably has become increasingly challenging for individual miners. This is where BlackRock’s scale, resources, and strategic vision come into play.

The premise of BlackRock’s strategy is relatively straightforward: by investing in Bitcoin mining operations, the company can secure a steady stream of newly minted bitcoins at a lower cost than buying them directly from exchanges. This approach offers several distinct advantages.

Firstly, by participating in mining, BlackRock gains exposure to Bitcoin while mitigating some of the risks associated with price volatility. While the market price of Bitcoin can fluctuate wildly in response to various factors, including macroeconomic trends and regulatory developments, the cost of mining remains relatively stable over the long term. This provides BlackRock with a degree of insulation against sudden price swings, allowing it to accumulate bitcoins at a predictable cost.

Secondly, by controlling a portion of the Bitcoin mining infrastructure, BlackRock can potentially influence the market dynamics and improve its own position. By strategically deploying mining resources, the company may be able to mine blocks more efficiently, thereby increasing its share of the newly created bitcoins. Additionally, BlackRock’s mining operations could contribute to the overall security and decentralization of the Bitcoin network, further enhancing the legitimacy and stability of the cryptocurrency.

However, perhaps the most compelling aspect of BlackRock’s strategy is its ability to acquire bitcoins at a discount relative to market prices. This discount arises from several factors inherent in the mining process.

One key factor is the economies of scale enjoyed by large mining operations like those backed by BlackRock. By investing in state-of-the-art mining hardware and securing favorable electricity rates through strategic partnerships and negotiations, these operations can significantly reduce their production costs compared to smaller, less efficient miners. As a result, BlackRock can mine bitcoins at a lower cost per unit than the prevailing market price, effectively providing the company with a built-in profit margin.

Additionally, BlackRock’s scale and financial resources enable it to take a long-term view of Bitcoin mining, allowing the company to weather short-term fluctuations in mining profitability. While individual miners may be forced to suspend operations or sell their bitcoins during periods of low profitability, BlackRock can maintain its mining activities and continue accumulating bitcoins, confident in the eventual return to profitability as market conditions improve.

Of course, BlackRock’s foray into Bitcoin mining is not without its challenges and potential drawbacks. The regulatory environment surrounding cryptocurrency mining remains uncertain in many jurisdictions, with concerns ranging from energy consumption to environmental impact. Additionally, competition within the mining industry is fierce, with new entrants constantly emerging and established players vying for market share.

Nevertheless, BlackRock’s decision to embrace Bitcoin mining underscores the growing mainstream acceptance and institutional interest in cryptocurrencies. By leveraging its expertise, resources, and scale, BlackRock aims to position itself at the forefront of this transformative industry, capturing value and generating returns for its investors in the process.

In conclusion, BlackRock’s strategy of acquiring Bitcoin at a discount through mining represents a bold and innovative approach to cryptocurrency investment. By harnessing the power of mining, BlackRock can accumulate bitcoins at a lower cost than market prices, providing the company with a competitive advantage and enhancing its exposure to the burgeoning digital asset market. As the cryptocurrency landscape continues to evolve, BlackRock’s strategic move could pave the way for further institutional adoption and investment in Bitcoin and other digital assets.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

www.rollmanmining.com

With the exponential growth of Bitcoin mining, choosing the right location for hosting sites is crucial.…

Introduction Proof of Work (commonly abbreviated to PoW) is a mechanism for preventing double-spends. Most major…

Since the year began, both bitcoin and the broader crypto economy have risen a great deal…