In a remarkable display of strength, bitcoin surged to a high of $47,526 on Feb. 9,…

You're reading

Posted at October 10, 2023 | Post by Victor Rollman

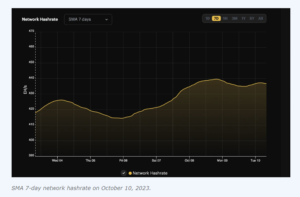

A week ago, at block height 810,432, Bitcoin miners dealt with a 0.35% rise in difficulty. Yet, on October 8, the Bitcoin hashrate soared to a new record. According to the seven-day simple moving average (SMA), it touched an impressive 440 exahash per second (EH/s). Notably, less than 200 days remain until the next block reward halving, equating to being roughly 28,468 blocks away.

The countdown to Bitcoin’s halving is ticking away. As of now, 197 days remain, positioning the event on or about April 25, 2024. Yet, some trackers project an earlier date of April 21, 2024, and there’s even calculations showing a March 2024 occurrence.

Currently, bitcoin miners receive a reward of 6.25 bitcoins for every block they discover. Post-halving, this bounty will drop to 3.125 coins per block. Such a shift is monumental for the miners securing the network, as their earnings will take a 50% hit.

Meanwhile, Bitcoin’s hashrate, in terms of the seven-day SMA, hit a record peak on October 8, 2023. The hashrate soared to 440 EH/s, even with the difficulty scaling a record 57.32 trillion.

Still wondering why different monitors display varying halving dates? It’s due to the block interval occasionally dipping below the ten-minute average, which has led to the difficulty ratcheting up twice already.

Furthermore, the most recent block interval was 8 minutes and 2 seconds, and projections estimate a difficulty rise between 3.71% and 5.8% by October 16, 2023. Miners are currently grappling with reduced earnings per petahash, with current rates slightly above $61 per petahash daily.

One contributing factor is BTC’s spot market price tumble, influenced by escalating tensions in the Middle East and mirrored dips in U.S. and European stock markets. The network has also witnessed a dip in transactional activity; post-September 23, daily transactions have been on a consistent downward trend.

A decline in daily inscriptions has largely driven this dip, leaving miners without fees from this avenue. On the bright side, miners successfully tackled a previously congested mempool containing over 500,000 unconfirmed transactions. However, the transactions they prioritized often yielded fees lower than the daily median or average.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

In a remarkable display of strength, bitcoin surged to a high of $47,526 on Feb. 9,…

We are moving to a fully digital world Thanks to the global internet, participants in the…

The Northern Data Group Subsidiary Prepares for Halving with Next-Gen Mining Infrastructure: Peak Mining, a subsidiary…