Introduction Proof of Work (commonly abbreviated to PoW) is a mechanism for preventing double-spends. Most major…

You're reading

Posted at February 9, 2024 | Post by Victor Rollman

In a remarkable display of strength, bitcoin surged to a high of $47,526 on Feb. 9, 2024, marking a significant uptrend in its price. With a market capitalization of $921 billion and a 24-hour trade volume of $32.56 billion, the market sentiment is overwhelmingly positive.

Oscillators and moving averages signal a bullish consensus, while the 1-hour, 4-hour, and daily charts underscore a consistent upward trajectory. Bitcoin’s price movement on the 1-hour chart showcases an uptrend, with higher highs and higher lows indicating strong buyer momentum. The presence of these upward swings suggests potential entry points at support levels, hinting at a robust bullish sentiment that could drive future gains.

The 4-hour chart also echoes this bullish trend, with a series of green candles forming higher highs. This pattern suggests that after brief periods of consolidation, bitcoin is primed for further upward movement. On a daily scale, bitcoin’s strong bullish momentum is unmistakable, reflecting significant investor confidence. The analysis of modest downturns within this uptrend suggests temporary pullbacks, offering strategic entry points for long-term bullish investors.

A deep dive into the oscillators reveals a mixed yet optimistic outlook. While the relative strength index (RSI), Stochastic, and other indicators remain neutral, the momentum and moving average convergence/divergence (MACD) level signal bullish sentiment, highlighting underlying market strength. Across the board, moving averages (MAs) from the exponential (EMA) to the simple (SMA) are unanimous in their buy signals. This alignment across various time frames underscores a solid bullish foundation for bitcoin, suggesting sustained upward momentum.

As bitcoin showcases remarkable resilience and breaks past resistance levels, the bullish indicators on the 1-hour, 4-hour, and daily charts suggest a strong upward momentum. The convergence of positive oscillator signals and moving averages indicates a robust bullish sentiment, potentially setting the stage for sustained growth in the coming weeks.

Despite the recent uptick, caution is warranted as overextended bullish runs often precede corrections. The bearish divergence on oscillators and resistance from key moving averages on the higher time frames suggest the potential for a pullback. Investors should remain vigilant for signs of trend exhaustion, which could signal a short-term reversal in bitcoin’s trajectory.

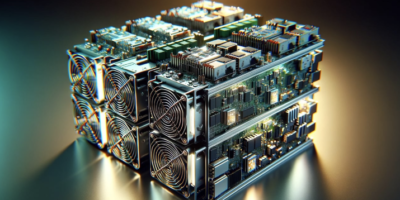

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

Introduction Proof of Work (commonly abbreviated to PoW) is a mechanism for preventing double-spends. Most major…

Blackrock, the world’s largest asset manager, has taken a significant step by officially filing its Ethereum…

November marked a significant milestone in the 2023 revenue generated by bitcoin miners, reaching a peak…