Mining Bitcoin and buying Bitcoin are two distinct approaches to acquiring the digital currency, each with its own advantages and considerations.

Let’s explore why mining Bitcoin can be advantageous compared to solely buying Bitcoin:

- Cost Efficiency: Mining Bitcoin is more cost-efficient with Rollman Mining, particularly in top-tier regions with the lowest electricity costs and access to affordable mining hardware. By setting up mining rigs, individuals can earn Bitcoin as a reward for contributing computing power to the network. In most cases, the cost of mining Bitcoin is lower than the cost of purchasing it directly from exchanges, especially during periods of price appreciation.

- Accumulation of Bitcoin Over Time: When mining Bitcoin, individuals gradually accumulate the cryptocurrency over time as they successfully validate blocks. This gradual accumulation can be advantageous in a volatile market, as it allows individuals to benefit from dollar-cost averaging. By mining and accumulating Bitcoin over an extended period, individuals can potentially reduce the impact of short-term price fluctuations on their overall investment.

- Participation in the Bitcoin Network: Mining Bitcoin allows individuals to actively participate in the operation and security of the Bitcoin network. Miners validate transactions, secure the network from attacks, and ensure the integrity of the blockchain. By becoming a miner, individuals contribute to the decentralized nature of the network and play a role in the consensus mechanism, which adds value to the broader Bitcoin ecosystem.

- Potential for Higher Returns: If the cost of mining (including electricity and hardware expenses) is lower than the market price of Bitcoin, miners can potentially generate profits. However, it’s important to consider that mining profitability is influenced by several factors, including Bitcoin’s price, mining difficulty, electricity costs, and the efficiency of mining hardware. Conducting thorough cost analysis and staying updated on market conditions is crucial before venturing into Bitcoin mining.

- Flexibility and Control: Mining Bitcoin provides individuals with a degree of flexibility and control over their acquisition of the cryptocurrency. Instead of relying solely on buying from exchanges, miners can actively engage in the process of generating Bitcoin. They can choose to hold or sell the Bitcoin they mine based on market conditions, personal preferences, or specific investment strategies.

In addition to comparing mining Bitcoin to buying Bitcoin, let’s explore why mining Bitcoin can be a compelling alternative to investing in real estate investment trusts (REITs), the S&P 500, and savings accounts:

- Potential for Higher Returns: Mining Bitcoin has the potential to generate higher returns compared to investing in REITs, the S&P 500, or savings accounts. Bitcoin’s historical performance has shown significant growth and has outperformed many traditional asset classes. While returns from REITs and the S&P 500 can vary, they generally tend to be more conservative. Savings accounts, on the other hand, typically offer minimal returns due to low-interest rates.

- Diversification and Low Correlation: Investing in Bitcoin mining adds diversification to a portfolio by incorporating an asset class that has a low correlation with traditional investments like REITs and the S&P 500. This low correlation can help reduce overall portfolio risk and potentially enhance returns during times of market volatility.

- Inflation Hedge: Bitcoin has gained attention as a potential hedge against inflation. Unlike savings accounts, which may offer limited interest that may not keep pace with inflation, Bitcoin’s finite supply and decentralized nature make it resistant to inflationary pressures. By mining Bitcoin, individuals can potentially benefit from its inflation-hedging properties.

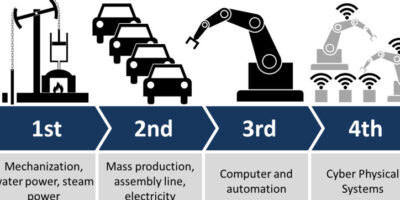

- Technological Innovation and Growth Potential: Mining Bitcoin allows individuals to participate in the technological innovation and growth potential of blockchain and cryptocurrencies. While REITs and the S&P 500 offer exposure to established industries and companies, they may not provide the same level of exposure to the transformative potential of emerging technologies like blockchain. By mining Bitcoin, individuals can align themselves with a rapidly evolving ecosystem and potentially capture the value created by technological advancements.

- Control and Ownership: Mining Bitcoin offers individuals direct control and ownership over the acquired assets. Unlike investing in REITs or the S&P 500, where ownership is represented through shares or funds, mining Bitcoin allows individuals to possess the actual digital currency. This ownership provides a level of autonomy and removes dependency on third-party intermediaries.

- Flexibility and Liquidity: Mining Bitcoin provides flexibility and liquidity compared to investing in real estate or savings accounts. Real estate investments often require significant capital and are less liquid, meaning it may take time to sell and convert assets into cash. Savings accounts, while readily accessible, offer limited liquidity and may have withdrawal restrictions. Bitcoin mining, on the other hand, allows individuals to easily convert mined Bitcoin into cash through various cryptocurrency exchanges.

In conclusion, mining Bitcoin offers the potential for higher returns, diversification, an inflation hedge, exposure to technological innovation, direct ownership, and flexibility compared to investing in REITs, the S&P 500, or savings accounts. However, it is crucial to thoroughly assess individual risk tolerance, financial resources, and stay informed about the dynamics of the cryptocurrency market before making investment decisions.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com