To review, bitcoin – plodding along in a very tight range of roughly $27,000-$28,000 for weeks on end – was jolted above $30,000 ten days ago after a media outlet tweeted that BlackRock’s spot ETF application had won U.S. Securities and Exchange Commission (SEC) approval. Within minutes, the tweet had been revealed as a mistake and bitcoin quickly gave back some, but not all of its gains.

Then early this week, some observers noticed the ticker for BlackRock’s spot bitcoin ETF – IBTC – showed up on trading clearinghouse DTCC’s website. Market participants read the news as signaling imminent SEC approval of the fund. The bullish signal caught shorts and dealers off guard, leading to a price spike to $35,000 Monday evening.

By Tuesday evening though, it was revealed that the IBTC ticker had been on the DTCC site for months and meant literally nothing with respect to whether a spot bitcoin ETF might be coming or not.

Yet the price of bitcoin remains very close to Monday’s high and at the current $34,400 is ahead nearly 30% over the past 10 days and more than 100% for 2023.

If not an ETF, then what?

“We now have the biggest asset managers in the world trumpeting bitcoin as a ‘flight to quality’ amidst devaluing fiat currencies and mounting global tensions and war. You couldn’t ask for more.”

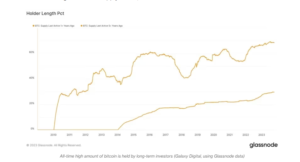

Some analysts argue that bitcoin is in demand as a safe-haven asset, noting prolific government spending and associated rising debt levels, shaky stock and bond markets, and the crypto’s increasingly constrained supply.

“We now have the biggest asset managers in the world trumpeting bitcoin as a ‘flight to quality’ amidst devaluing fiat currencies and mounting global tensions and war,” said Charles Edwards, founder of Capriole Investments. “You couldn’t ask for more.”

“After 2022 tricked so many into thinking that digital assets are correlated to stocks and bonds, many are left scratching their heads at the ‘new’ old normal,” Jeff Dorman, chief investment officer at Arca pointed out. “A debt spiral leads to a loss of confidence in banks and governments and a repricing of risk-free rates amidst record supply, which is bad for bonds and equity valuation models, but good for alternative forms of wealth and money creation,” he added.

Hedge fund giant Paul Tudor Jones touted gold and BTC as attractive investment options while geopolitical risk and “untenable” U.S. debt levels make it difficult to own stocks.

As the classic 60% stocks, 40% bonds portfolio is enduring one of its worst periods, an uncorrelated asset like BTC could be a potent contender to diversify, K33 Research and CoinShares argued separately.