In a surprising turn of events, a Bitcoin whale that had remained dormant for over a decade has…

You're reading

Posted at October 10, 2023 | Post by Victor Rollman

Tabar, head of a $200 million bitcoin mining firm, pointed to bitcoin’s digital scarcity, potential for sustainability and more

Sam Tabar, the CEO of sustainability-focused bitcoin mining firm Bit Digital (BTBT), has a $12 trillion outlook on the value that the original cryptocurrency presents our increasingly-digital world.

“Bitcoin is digital gold,” he said in a recent conversation with Roundtable anchor Rob Nelson, comparing BTC to one of the highest market cap assets in history.

During their conversation, Nelson sought to unravel some of the enigmas surrounding bitcoin mining with Tabar, an executive who holds years of experience in the mining and traditional financial spaces, with roles at Fluidity, FullCycle Fund, Bank of America Merrill Lynch and more.

“(Bit Digital is) a big mining company,” Nelson said, alluding to the firm’s $200 million market cap. “I don’t think most people, particularly not in the crypto space, even understand that bitcoin is ‘mined.'”

For many, the idea of mining evokes images of backbreaking labor and excavations. However, unlike that of traditional commodities, bitcoin’s mining is a virtual process, though it does demand energy, resources and sophisticated expertise.

“Mining is a term that was mentioned in Satoshi’s white paper — it’s basically a data processing center,” Tabar clarified.

He added that, in this digital realm, Bitcoin miners validate transactions and create new blocks on the blockchain, receiving bitcoin as their reward.

However, the crux of the discourse was the comparison of bitcoin to gold. In this light, Tabar advocated for bitcoin’s potential as a future hedge against inflation. His conviction stems from the belief that, as the world of finance evolves, bitcoin might overshadow the traditional gold industry, especially given the ethical and environmental concerns surrounding gold mining.

Tabar’s reflections on historical events, such as World War II, where savings and assets were seized, underscored bitcoin’s value proposition further.

“If bitcoin existed in World War II, many would still be able to retain the value of their hard-earned savings,” he pointed out.

As the dialogue concluded, Tabar highlighted bitcoin’s unique qualities. Contrary to traditional currencies that are susceptible to inflation, bitcoin is limited to 21 million units, endowing it with inherent deflationary attributes. This could potentially cement bitcoin’s position as the world’s pioneering global currency.

This conversation between Nelson and Tabar emphasized bitcoin’s vast potential — not merely as a digital currency, but as a repository of value, an inflation hedge and possibly the keystone of future global trade and wealth preservation. In the face of evolving economic paradigms, bitcoin might just herald a decentralized and equitable fiscal future.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

In a surprising turn of events, a Bitcoin whale that had remained dormant for over a decade has…

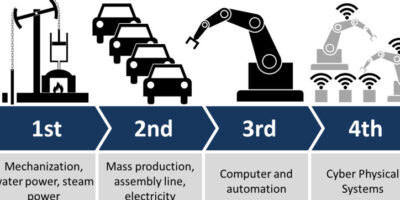

We are moving to a fully digital world Thanks to the global internet, participants in the…

The Solana Foundation, the institution in charge of managing initiatives related to the Solana network, has…