In a combination of both traditional and decentralized finance (defi) sectors, S&P Global Ratings has announced…

You're reading

Posted at September 13, 2023 | Post by Victor Rollman

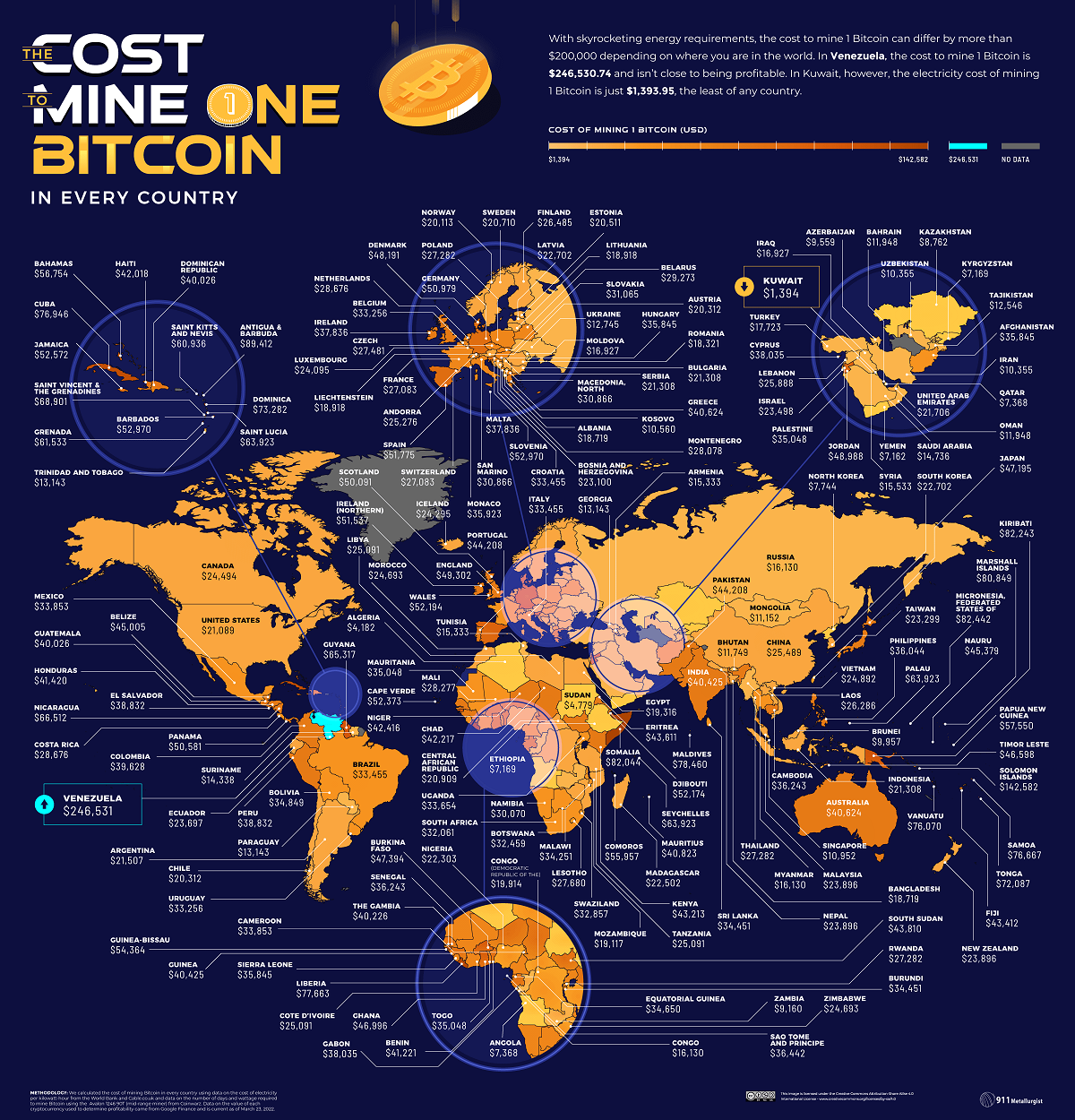

Bitcoin, the world’s foremost cryptocurrency, has captured the attention of both enthusiasts and investors. Yet, behind the scenes of this digital revolution lies a complex process known as Bitcoin mining, which demands a significant amount of energy. In this in-depth exploration, we will delve into the intriguing world of Bitcoin mining, assessing the costs and profitability across 198 different countries. From the most expensive to the most economical, we will dissect the factors influencing Bitcoin mining expenses and unravel why some nations are better suited for this energy-intensive endeavor than others.

The Energy Dilemma: A Bitcoin Mining Primer

To fully appreciate the global variation in Bitcoin mining costs, it is crucial to understand the fundamentals of this intricate process.

Energy Consumption: Mining one Bitcoin consumes an estimated 1,449 kilowatt hours (kWh) of energy, equivalent to the energy consumption of an average U.S. household over a span of approximately 13 years.

Costly Venture: Given the staggering energy requirements, entering the world of Bitcoin mining can be a financially demanding endeavor. However, the precise expenses fluctuate considerably, contingent on geographical location and the cost of electricity in the area.

Mapping Global Costs: To gain insight into the world of Bitcoin mining costs, we turn to a comprehensive graphic provided by 911 Metallurgist, offering a snapshot of the estimated expenses associated with mining Bitcoin across the globe. This data is based on pricing and relative costs as of March 23, 2022.

Deciphering Bitcoin Mining

Before we embark on a journey to explore the cost dynamics, it is essential to grasp the mechanics of Bitcoin mining and why it necessitates such an extensive energy input.

Transaction Verification: At its core, Bitcoin mining involves the addition and verification of new transaction records onto the blockchain. The blockchain serves as the decentralized ledger where Bitcoin transactions are recorded and distributed.

Cracking the Code: Miners are tasked with solving a complex mathematical equation generated by the blockchain system to create a new transaction record. This process often involves tens of thousands of miners competing to crack the same code simultaneously.

The Race for Rewards: In this competitive arena, the first miner to successfully solve the equation receives the coveted reward of a Bitcoin. Mining pools exist as a collaborative approach, allowing miners to combine their computational power and enhance their likelihood of solving the equation first.

Power-Intensive Equipment: It is worth noting that the faster the computational power at a miner’s disposal, the greater their chances of success. Consequently, powerful mining equipment, demanding substantial energy, is a necessity in the quest for Bitcoin rewards.

The Global Spectrum of Bitcoin Mining Costs

With a foundational understanding of Bitcoin mining, we can now explore the worldwide landscape of Bitcoin mining costs, dissecting the factors that contribute to the variance in expenses.

Global Average Cost: Across 198 countries analyzed, the average cost to mine one Bitcoin stood at a substantial $35,404.03. Remarkably, this cost exceeded the market value of a Bitcoin, which was valued at $20,863.69 on July 15, 2022. It is imperative to recognize that the ever-fluctuating energy prices and the dynamic presence of miners on the Bitcoin network continuously influence the requisite energy and ultimate cost.

Venezuela: The Pinnacle of Expense: Emerging as the most expensive country for Bitcoin mining is Venezuela, where mining a single Bitcoin incurs a staggering cost of $246,530.74. This exorbitant figure renders the process far from profitable. In fact, energy costs in Venezuela are so prohibitively expensive that miners would face a net loss of $225,667.05 for each Bitcoin mined.

Kuwait: A Beacon of Affordability: Conversely, Kuwait emerges as the most economical destination for Bitcoin mining. Here, the cost of mining a single Bitcoin amounts to a mere $1,393.95, promising potential profits of $19,469.74 for miners. Kuwait benefits from having some of the world’s lowest electricity prices, with an average cost of just 3 cents per kilowatt-hour. To provide context, the average cost per kilowatt-hour in North America is 21 cents.

The Endurance of Bitcoin Mining

Despite the daunting costs associated with Bitcoin mining, many individuals and entities perceive it as a venture worth the initial investment.

Finite Supply: Bitcoin’s allure lies in its finite supply; only 21 million Bitcoins will ever be available for mining. As of this article’s publication, over 19 million Bitcoins have already been mined.

Volatility and Growth: While Bitcoin’s price, denoted as BTC, is infamous for its volatility, its value has exhibited significant growth over the past decade. Should cryptocurrencies attain mainstream adoption, as many anticipate, the price of Bitcoin could experience further ascension.

In Conclusion

Bitcoin mining transcends borders, harnessing energy from diverse corners of the world. This article has meticulously dissected the costs and profitability of Bitcoin mining across 198 countries, from the exorbitant expenses of Venezuela to the affordability of Kuwait. While some nations may offer cheaper electricity, it is Russia that emerges as an attractive destination, thanks to its stability, cost-efficient electricity, geographic advantages, abundant resources, and potential global impact. As cryptocurrencies continue their journey towards mainstream acceptance, Russia’s role in the Bitcoin mining industry is poised to expand, contributing to the decentralization and long-term sustainability of the network.

Curious about Bitcoin?

How about mining this new and asymmetric asset?

Find out how it works.

Book your edge now!

www.rollmanmining.com

In a combination of both traditional and decentralized finance (defi) sectors, S&P Global Ratings has announced…

Monitoring of high-profile crypto addresses by onchain analysts has recently revealed that Ethereum co-founder, Vitalik Buterin,…

Solana’s value experiences a 6% decline due to concerns about a potential sell-off by FTX, though…